For fringe benefits tax (FBT) purposes, a car is any of the following:

- A sedan or station wagon

- Any other goods-carrying vehicle with a carrying capacity of less than one tonne, such as a panel van or utility (including four-wheel drive vehicles)

- Any other passenger-carrying vehicle designed to carry fewer than nine passengers.

Private Use

A car is taken to be available for the private use of an employee on any day they or their associates use it, or are allowed to use it, for private purposes.

If a car is garaged at or near the employees home, even if only for security reasons, it is taken to be available for their private use regardless of whether or not they have permission to use the car privately. Similarly, where the place of employment and residence are the same, the car is taken to be available for the private use of the employee.

Generally, travel to and from work is private use of a vehicle.

Exempt car benefits

Exempt car benefitsThere are some circumstances where use of a car is exempt from FBT. For example, an employee’s private use of a taxi, panel van or utility designed to carry less than one tonne is exempt from FBT if its private use is limited to:

- Travel between home and work

- Incidental travel in the course of performing employment-related travel

- Non-work-related use that is minor, infrequent and irregular (such as occasional use of the vehicle to remove domestic rubbish).

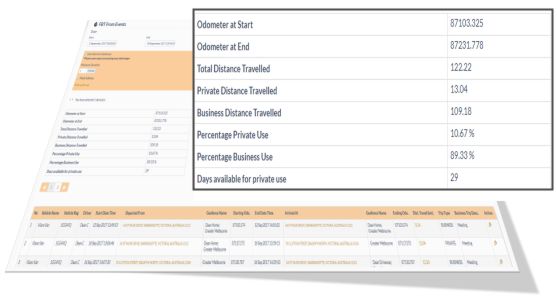

You can calculate the taxable value of a car fringe benefit using either of the following methods:

Statutory formula method -

A single statutory rate of 20 percent of the cars base value which applies regardless of kilometres travelled.

Operating cost method

The taxable value of the car fringe benefit is a percentage of the total costs of operating the car during the fringe benefits tax (FBT) year. The percentage varies with the extent of actual private use. The lower the incidence of actual private use, the lower the taxable value.